san francisco gross receipts tax 2021 due dates

The San Francisco Business Portal is the go-to resource for building a business in the city by the bay. Businesses will pay the payroll tax for the last time in 2017 and begin paying only the gross receipts tax in its place in 2018.

Annual Business Tax Returns 2021 Treasurer Tax Collector

An extension can be filed by February 28 2018 to extend the filing due date to May 1 2018 under the condition that the person made payments of at.

. Lean more on how to submit these installments online to comply with the Citys business and tax regulation. Tax filings are required to be. In 2022 San Francisco has many unique corporate tax deadlines beyond the traditional April 15th tax return date.

To be considered timely filed a taxpayer. Under the general rule the registration fee is 90 for businesses with less than 100000 in receipts which increases to 35000 for businesses with more than. Due Dates for Quarterly Installment Payments.

The filing obligation and tax rates for all three taxes vary based on the industry the business is involved with. Leave a Comment Uncategorized. Who is subject to San Francisco gross receipts tax.

The San Francisco Gross Receipts Homelessness Gross Receipts Commercial Rents andor Payroll Expense tax. If you received instructions from our office to complete the 2021-22 Business Registration Renewal Due November 1 2021 use the button below to download the renewal form. Persons other than lessors of residential real estate must file applicable Annual Business Tax Returns if they were engaged in business in San Francisco in 2021 as defined in Code section 62-12 qualified by Code sections 9523 f and g and are not otherwise exempt under Code sections 954 2105 and 2805 unless their combined taxable gross receipts in the City.

To provide COVID-19 pandemic relief the 2020 filing and final payment deadline for these taxes has been moved to April 30 2021 and the deadline to make. The deadline to file tax returns for all three taxes is February 28 2022. The 2021 filing and final payment deadline for these taxes is February 28 2022.

Taxpayers may file their 2021 Business Tax Renewal Form online available on the Los Angeles City Finance Departments website. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments. The 2021-22 San Francisco Business Registration Renewal due date has been extended from May 31 2021 to June 30 2021 for taxpayers with more than 25 million of taxable gross receipts calculated on the 2020 Annual Business Tax Return due April 30 2021.

The deadline for paying license fees for the 2022-2023 period is March 31 2022. The 2017 gross receipts tax and payroll expense tax return is due February 28 2018. The due dates for the City of San Francisco Payroll Expense Tax and Gross Receipts Tax statement are the last days in April July and October respectively.

2021 San Francisco Gross Receipts. The three taxes are the San Francisco Gross Receipts Tax the Homelessness Gross Receipts Tax and the Commercial Rents Tax. Find due dates for important license renewals tax statements and reporting forms below.

Performing any work including solicitation within the city for all. Down from 0829 for tax year 2016. Payroll Expense Tax and.

San Franciscos doing business nexus standards include maintaining a fixed place of business within the city. The due date for filing the san francisco 2021 annual business tax sf abt return which includes reporting and payment of 1 the gross receipts tax grt or administrative office tax aot 2 the homelessness tax hgrt or the homelessness administrative office tax haot. Estimated tax payments due dates include April 30th August 2nd and November 1st.

Important filing deadlines include the San Francisco Gross Receipts filing deadline of February 28 and the April 1st business property tax filing. The penalty structure for all business taxes and fees for tax years 2020 and prior and Business Registration Renewal 2021 and prior can be found hereAll other Business tax filings and payments received or postmarked after the deadline are generally subject to penalties and fees specified under Section 617-11. The 2021-22 San Francisco Business Registration Renewal due date has been extended from May 31 2021 to June 30 2021 for taxpayers with more than 25 million of taxable gross receipts calculated on the 2020 Annual Business Tax Return due April 30 2021.

San Francisco businesses are also subject to annual registration fees based on San Francisco gross receipts for the immediately preceding tax year. San Francisco voters on November 3 2020 approved two propositions that will increase the citys gross receipts tax. Fri 08012014 - 1227.

This tax adds to san franciscos broader gross receipts tax which applies rates ranging from 016 percent to 065 percent for firms with more than 1 million in gross receipts. San francisco gross receipts tax 2021 due dates. City and County of San Francisco 2000-2021.

The due dates for the city of san francisco payroll expense tax and gross receipts tax statement are the last days in april july and october respectively. A late payment penalty equal to the fee or tax multiplied by. 2021 Annual Business Tax Returns.

Additionally businesses may be subject to up to four local San Francisco taxes. You dont have to miss a deadline. Calculations of 2022 estimated quarterly business tax payments will be based on the information entered in your San Francisco Annual Business Tax Return for 2021 and will be displayed in the payment portal within 24 hours of completing your filing.

The due date for filing the San Francisco 2021 Annual Business Tax SF ABT return which includes reporting and payment of 1 the Gross Receipts Tax GRT or Administrative Office Tax AOT 2 the Homelessness Tax HGRT or the Homelessness Administrative Office Tax HAOT and 3 the Commercial Rents Tax CRT is February. For the 2021 Business Tax Renewal based on calendar year 2020 the due date to file the Los Angeles Business Tax is March 1 2021 as February 28 2021 falls on a Sunday. Annual business registration fees.

For the Gross Receipts Tax GR we calculate 25 of your Gross Receipts Tax liability for 2021. For taxpayers with less than 25 million of taxable gross receipts the due date has been. Beginning in 2021 Proposition F named the Business Tax Overhaul raises gross receipts tax rates for all businesses when it is fully implemented.

It also repeals the citys payroll expense tax.

Key Dates Deadlines Sf Business Portal

San Francisco Is Projected To Have 6 3 Billion To Spend In 2022 2023 Here S How The Pandemic Is Impacting Those Numbers

San Francisco Set To Begin 2021 With Gross Receipts Tax Increase New Levy On Overpaid Executives To Take Effect In 2022 Andersen

Paypal Shuttering Its San Francisco Office Techcrunch

California San Francisco Business Tax Overhaul Measure Kpmg United States

Working From Home Can Save On Gross Receipts Taxes Grt Topia

The Downturn Persists Examiner Analysis Reveals That S F S Economy Has A Long Road To Recovery The San Francisco Examiner

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

Twitter Helps Revive A Seedy San Francisco Neighborhood The New York Times

San Francisco S New Local Tax Effective In 2022

San Francisco Businesses On The Brink After Lockdowns Fires

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

Covid 19 Response Treasurer Tax Collector

San Francisco Taxes Filings Due February 28 2022 Pwc

San Francisco Gross Receipts Tax

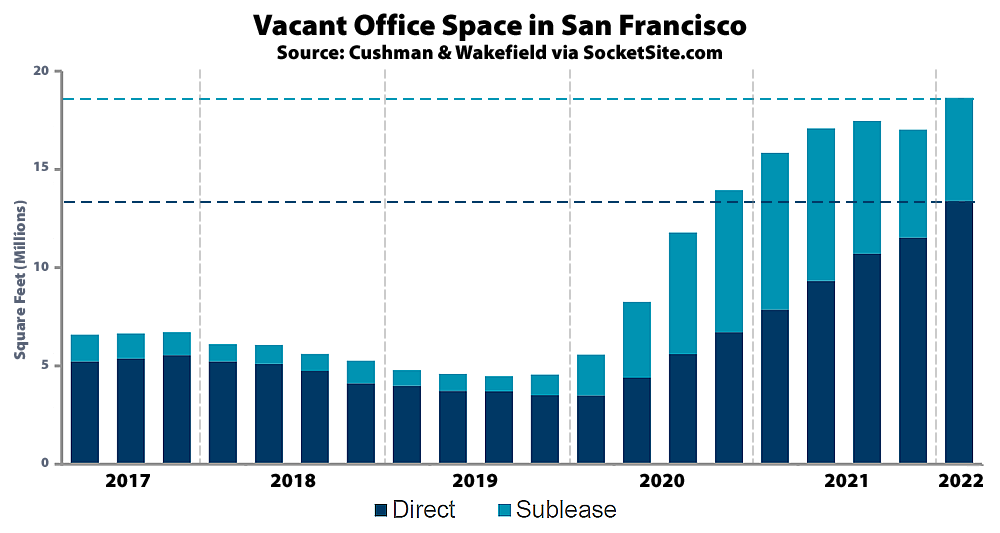

Office Vacancy Rate In San Francisco Hits A Pandemic High

Homelessness Gross Receipts Tax

San Francisco Adopts Major Changes To Business Taxes 2019 Articles Resources Cla Cliftonlarsonallen